by Robert Plant, Sales Director, Impulse Embedded Ltd.

For system integrators and OEMs who use industrial computers or IIoT devices in their systems it’s a safe bet that many will have seen price increases in their supply chain recently. What frustrates most is seemingly nonsensical price hikes without any proper explanation of the whys and wherefores behind them. Industrial computers are made from a complex bill of materials, and the industry is underpinned by the principals of revision control, advanced product change notification and longevity of supply. When the pillars of our industry are threatened by instability in the supply chain, we all react in slightly different ways; some of us bend, some break, but the practical amongst us will review the current situation and ask what, if anything, can be done about it.

.

The current state of the market

We are all aware that integrated circuits (IC) are in short supply, our world has come to rely so heavily on semiconductors that almost all of us will have felt the effects of the shortages. Parents scrambling to find stock of the latest PS5 console (PlayStation 5), to those paying way over the odds on the second-hand car market due to the demand created as new vehicle lead times continue to extend into many months and even years.

But what is affecting our industry specifically? The Industrial Computing industry, where we more often favour reliability and stable supply over the latest cutting-edge technology, is carrying the brunt of IC shortages as continuity of all components continues to be paramount. Surely the demand for IC’s is driven by the car manufacturers desire to electrify and use leading edge memory and processors, or the likes of Intel and AMD pushing for 7nm technology. That’s certainly a factor, but our reliance on interoperability and the need to keep older machines up and running plays a much bigger part than we might think.

.

Size matters

Chip manufacturers make their products from round wafers which are classified by their diameter. The two main sizes of wafer in current production are 200mm and 300mm. In the 2000’s the Semicon industry began to transfer its focus from 200mm to 300mm fabs as although the 300mm fabs are more expensive, they support more advanced technologies and allow the chipmakers to innovate with their products, an example of which is Intel’s Tiger Lake processor family. Demand for 200mm fabs remained buoyant however, and as there was well established 200mm capacity, supply was able to keep up with demand. Fast forward a few years to early 2020 however, and www.semiengineering.com reported that demand for the 200mm fab capacity was again growing, and there were even warning signs of an imminent shortage.

Price increases

Industrial Computers and IIoT devices by their nature use a lot of chips manufactured using the more established (mature node) 200mm wafers; chips like CMOS image sensors, display driver ICs, flash memory controllers, microcontrollers and power management ICs. Not only is demand increasing as more and more devices become connected, but supply of these components has continued to worsen throughout 2020 and 2021 with resulting lead times for some critical components currently showing as long as 52 weeks.

Due to the global nature of the chip supply chain, it’s not only the manufacturing process that has been under pressure. Testing and transportation services share the burden of increased demand, but COVID-19 has adversely affected worker availability, factory uptime and global logistic delivery times due to reduced air and sea shipments.

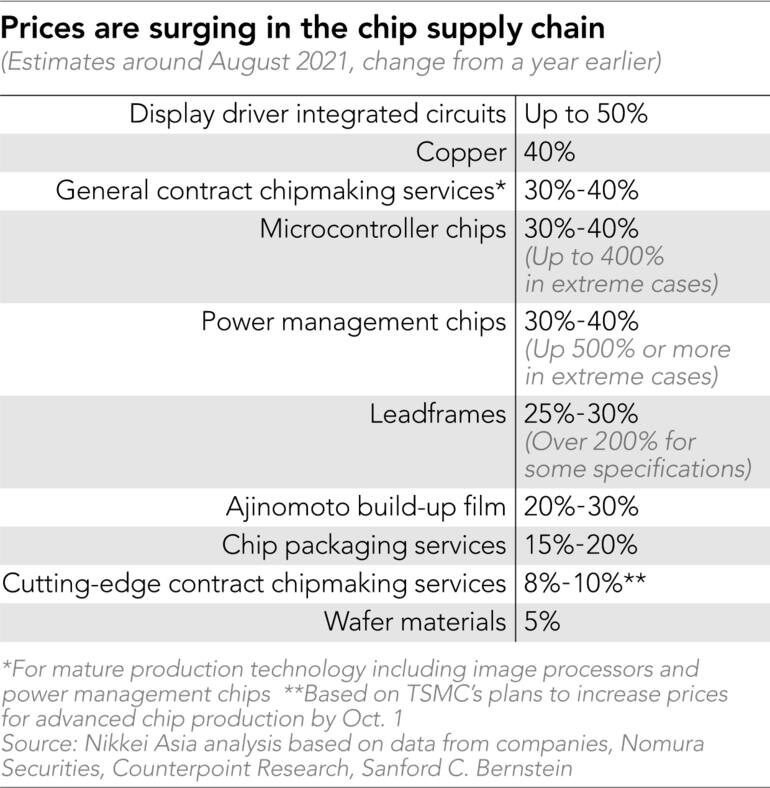

Nikkei Asia published the table below to show the current price increases of legacy chips in 2021, compared to the same time in 2020. All these impacted chips are are found in the Industrial Computing and IIoT market.

It’s no surprise then that given the perfect storm of events beginning to converge over the past couple of year that prices are set to rise again in 2022.

Taiwan’s TSMC (Taiwan Semiconductor Manufacturing Company) has over half the world’s foundry market at their command, with their 200mm and 300mm foundries all churning out wafers at full capacity. In normal conditions their services command a premium price, and with clients like Apple, NVIDIA and Qualcomm all happy to pay it, TSMC have until recently been able to weather the storm and held off increasing their prices unlike many of their competitors who have already done so. However, on October 1st, 2021 price rises for TSMC customers officially took effect, the effects of which will slowly filter through the supply chain in 2022 as existing contracts expire and the chipmakers are forced to adjust their prices accordingly. It therefore seems logical that the price for systems in the industrial computing market is set to take a double hit throughout 2022.

What can we do?

This is a much harder question to field, as the answer really depends on the product in question, the chips it contains and the nature of the demand. For OEMs who have established product lines with stable sales history, it’s much easier to forecast demand and put large back orders into place to hold current prices. But for system integrators whose demand is more reliant on project work it’s difficult to commit to larger covering orders, especially given the current economic uncertainty caused by a certain global pandemic and pressures on exchange rates.

This leaves a large percentage of Industrial Computer and IIoT product consumers in a position where they need to react to demand, quickly consider alternative products or be creative with supplier purchasing agreements to stay ahead of the curve. One such example of supply chain creativity is to question the product vendor about which chips are causing extended lead times, and whether the vendor is willing to purchase chips on the spot market to mitigate the delays. The nature of the more established chips in IIoT products means that chip distributers tend to stockpile them, and whilst this increases the price, for those willing to pay the increase the resulting reduction in lead time often makes commercial sense.

Being flexible on specification is another weapon in the armoury. A lot of time is spent on arriving at the perfect hardware specification, and whilst software resource is consumed in the product development cycle, often an alternative hardware platform with a similar specification can be sourced and migrated to without too much upheaval in the process.

Regardless of how frustrating the current situation might be, working together, forming better relationships with suppliers and having trust in the information at our fingertips seems to be the only way to weather the storm. One thing is for certain, those who do little to prepare may have an unpleasant surprise in store next year, as the rest of the industry is set to hunker down and do what they can to keep the wheels of industry turning.

Get in touch with our team

For hardware requirements in upcoming projects, no matter how far in advance the expected delivery date, it is worth speaking to a system provider such as Impulse Embedded to ascertain the impact of this global components shortage on the supply of all required products. Impulse Embedded will be pleased to discuss the implications of any delays and how they may affect you, and help mitigate these delays with their decades of industrial computing experience and dedicated, trusted partnerships with global computing manufacturers.

Speak to Impulse Embedded on +44(0)1782 337 800 or visit their website at www.impulse-embedded.co.uk.

image courtesy of Intel Corporation